ROBBING US BLIND

Palin proof: sexism remains

Stop and ask any student at Southern to define separation of church and state and they will undoubtedly give you a textbook-answer. This is not an accident. Since the first grade it has been preached to us over and over again from our teachers’ pulpits. We have failed, however, to drill into student’s heads the equally crucial “separation of bank and state,” a concept completely lost in current politics.

Need cash fast? The Federal Reserve will simply print more money. Going bankrupt? Uncle Sam will pay the debt for you, with other’s money of course. When the financial you-know-what hit’s the fan, it’s not surprising to see both “sides” calling for immediate, sweeping action. To fail to do so would result in “… massive job losses, devastate retirement accounts and further erode housing values, as well as dry up loans for new homes and cars and college tuitions,” according to President George Bush.

Such urgency should be alarming when dealing with powerful legislation. The goal, according to Bush, is to have something passed by Congress by the end this week when lawmakers recess for the elections. More often than not, it’s during these times of “crisis” that the most power-grabbing legislation is passed. A well-known example is the unbelievably rapid drafting and passing of the Patriot Act after Sept. 11, 2001.

This is what they do. Create a problem, feed off the people’s fear of the looming crisis and “fix” the problem by increasing the scope of government. Their formula always has the same results: a net increase in power for the rulers and a net loss in liberty for the ruled.

But how could the government create such a financial crisis? Easy; they’ve been doing it for years.

The main source of the problem is the mysterious entity we call the Federal Reserve. Contrary to popular belief, the Federal Reserve is not the government. Rather, it is a group of private bankers and financiers who have a monopoly on our economy. They continually manipulate the market by increasing and decreasing the money supply, causing the value of the dollar to rise and fall.

Another misconception held by most Americans is that the Federal Reserve can simply print more money when needed. This so called “money” is actually worthless. American paper money is actually debt bank notes that have been declared legal tender. They are only worth their weight in gold. And since there is no gold in the United States Treasury to back them up, they are basically worthless.

Every time the government borrows money (debt bank notes) from the Federal Reserve they owe the Fed the “money” returned plus interest. It’s a never-ending spiral of debt. The U.S. government is already well over $9 trillion in debt, yet they are proposing spending more than $700 billion to bailout others who are in less debt. Such a proposal falls nothing short of pure insanity.

The second cause behind the current financial crisis is the now forgotten “Community Reinvestment Act” of the Clinton Administration. The act, passed by Congress, requires banks to offer loans and credit to the “underprivileged” (aka high risk borrowers). As a result, many underprivileged were unable to make good on their promises to pay back, causing panic among financial institutions and on Wall Street. Seeing the writing on the wall, they’re now looking to the federal government to bail (or buy) them out. The Association for Financial Professionals is calling it “a meltdown in U.S. home prices after a frenzied real-estate boom fueled by easy credit.”

The rest is history, or perhaps more accurately, the rest is history, repeated.

In 1929, the largest stock market crash in the history of America occurred, resulting in the Great Depression. In the years prior to 1929, the Federal Reserve greatly increased the money supply, creating a false sense of security and resulting in extensive loans to small banks and the public. But in 1929, the Fed called-in those loans resulting in nationwide panic and a crash in the market.

Congressman Louis T. McFadden had this to say about the crisis:

“It was a carefully contrived occurrence. International bankers sought to bring about a condition of despair, so that they might emerge the rulers of us all.”

The current financial crisis is one that has been carefully calculated. And who looks benefit? The federal government and the bankers. They have already rescued investment bank Bear Stearns in March, taken over the mortgage giants Fannie Mae and Freddie Mac and are now taking over the world’s largest insurance company, American International Group.

This is nothing less than a socialized banking industry created by an unconstitutional power grab. The federal government is in bed with the money powers but it’s the American people that are getting screwed. Thomas Jefferson warned about the dangers of such an industry saying, “I believe that banking institutions are more dangerous to our liberties than standing armies.”

So what should we as Americans do? Vote perhaps? Neither Barack Obama nor John McCain are going to stem the tide washing away our freedoms. They will stand by and do what they are told, furthering America’s loss of sovereignty and our loss of individual liberty. No; Americans first need to get mad.

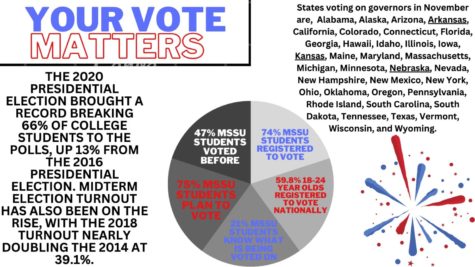

Your donation will support the student journalists of Missouri Southern State University. Your contribution will allow us to purchase equipment and cover our annual website hosting costs.