Done: McCaskil and Bond weigh in on bailout vote

WASHINGTON (AP) Missouri’s two senators voted Wednesday in favor of a retinkered bill to rescue the nation’s financial industry, calling the measure key to halting a growing credit crisis.

Democratic Sen. Claire McCaskill said before the roll call she would “hold her nose” when voting for the $700 billion plan, although she praised changes in the bill that add more government oversight and accountability.

Republican Sen. Kit Bond said the bailout plan was needed “to keep the credit crisis from spreading from Wall Street to Main Street, which would put workers’ paychecks, families’ savings and seniors’ retirement in jeopardy.”

The Senate passed the measure 74-25, and the House could vote on it by the end of the week. House leaders say prospects are improving for passage of the bailout package after lawmakers narrowly rejected it Monday.

McCaskill said the gears of the nation’s economy are frozen because no lending is going on, making it hard for small businesses, college students and thers to get loans.

“It will have a domino effect on our economy if the credit market remains frozen,” McCaskill said.

She stressed that the bill is not a blank check being written to make failed financial institutions whole. While the government plans to buy bad mortgages and other shaky assets for pennies on the dollar, McCaskill said there’s a good chance those assets can be resold later at a profit once the credit crisis ends.

The Senate version of the bill includes tax breaks and a provision to exempt more than 20 million middle-class Americans from the alternative minimum tax. It also would increase the government’s $100,000 cap on insured bank deposits to $250,000.

Bond said he was satisfied that the latest compromise bill includes more oversight to protect taxpayers and prevent failed chief executive officers from receiving “golden parachutes.”

To highlight the local effects of the crisis, McCaskill noted that even smaller banks in Missouri are being affected by a “stunning” lack of liquidity.

McCaskill said she spoke recently to owners of a mom-and-pop store who can’t get a loan to expand their business. She also described talking to a Missouri businessman who had expected to receive a loan at 3.2 percent interest but is now seeing the same loan jump to 10 percent.

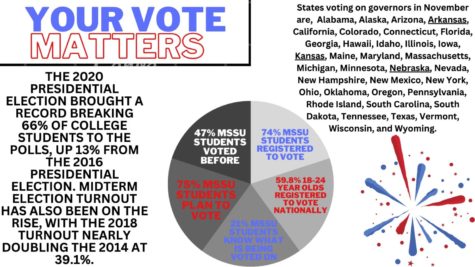

Your donation will support the student journalists of Missouri Southern State University. Your contribution will allow us to purchase equipment and cover our annual website hosting costs.