House passes new bill

JEFFERSON CITY, Mo. – The Missouri House of Representatives passed a “Geoffrey Loophole” bill Jan. 28 that will stop multi-state corporations from avoiding Missouri taxes by transferring money to out of state holding corporations.

“The legislation puts forth language that is fair for everybody,” said Rep. Marilyn Ruestman (R-Joplin). “The Department of Revenue will have clear guidelines, and the courts will have the language they need to rule.”

The bill was created through research and analysis of more than 30 court cases. This bill will establish requirements a company must meet in order to receive tax deductions through a holding company arrangement.

“The Missouri House effectively closed the corporate tax loophole without increasing taxes on legitimate Missouri business,” said Rep. Shannon Cooper (R-Henry).

Some lawmakers have contended tax deductions for franchises and trademark fees should be removed. Others argue this would unfairly raise taxes on many of Missouri’s small businesses.

Ruestman said in her community there were a number of small business franchises, including McDonald’s, Ci Ci’s Pizza and Long John Silver’s. These businesses are owned locally. She said they already pay their fair share of taxes, and they are the ones who sponsor local organizations, such as little league, sports teams, parades and other community events.

The Senate also introduced a bill that would provide for tax exemptions. Bill 1048 allows churches, charitable groups and other tax exempt organizations to just bring proof of tax-exempt status when renewing motor vehicle registration.

Sen. Gary Nodler (R-Joplin) said, it is not an easy task for such organizations to renew vehicle registration.

“Last December, I visited the Carl Junction Senior Citizens Center,” Nodler said. “While talking to a local resident, I learned that when it was time to renew his organization’s motor vehicle license registration, a special trip had to be made to the county assessor’s office to certify the center was in fact tax exempt.”

Senate Bill 1099 will also establish reporting requirements to assist future legislatures in assessing the value of tax credit programs. It will also implement a system for reporting. Failure to meet annual requirements could result in penalties. This would update the current program. The bill has not yet gone to the Senate floor for debate.

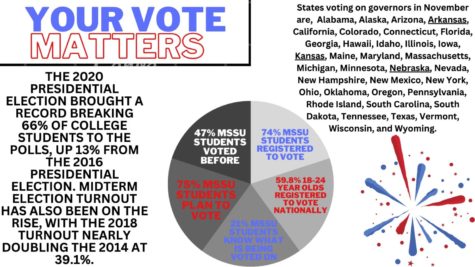

Your donation will support the student journalists of Missouri Southern State University. Your contribution will allow us to purchase equipment and cover our annual website hosting costs.