As of January 21st, senior residents of Jasper County, Missouri, can apply for a new property tax credit aimed at easing financial burdens caused by the rise in property taxes. The credit is available to seniors aged 62 or older who own and live in a home in Jasper County as their primary residence. This property tax credit program has been implemented in other counties in Missouri, and many seniors showed interest. For example, Greene County recently started the program and received over 15,000 applications, modeling the need for the program in other underserved areas of Missouri. As property taxes continue to increase, the credit helps seniors (particularly those with a fixed income) maintain their homes without facing overwhelming financial strain.

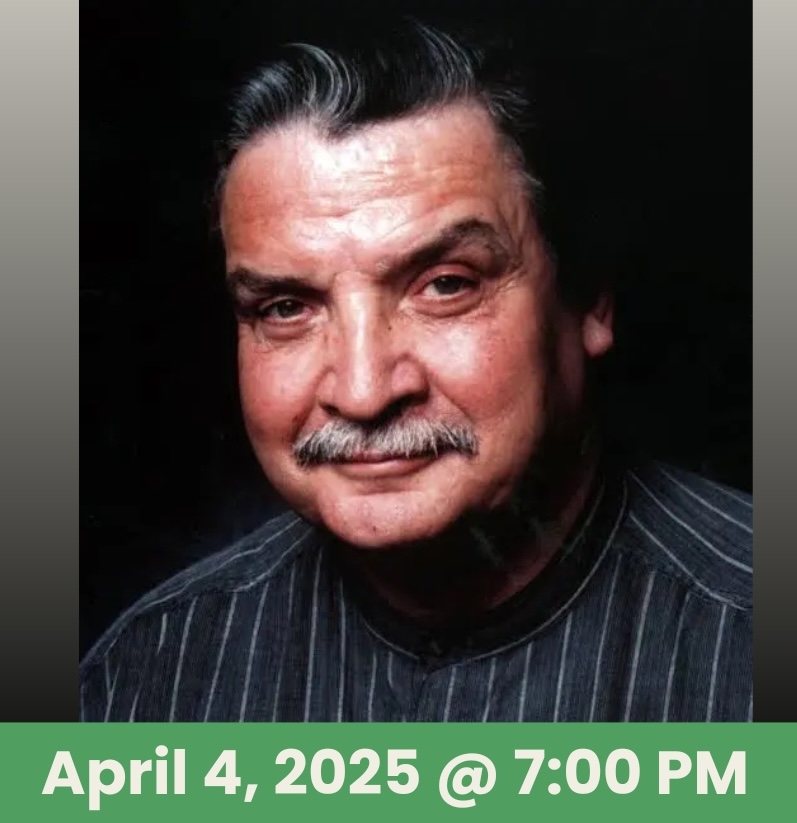

Since counties are able to set their own rules regarding the program, it is important for seniors to stay informed about their specific county’s application requirements to maximize the benefits of the credit. To help seniors and their families to better understand the complicated law and the process of applying, MSSU’s KGCS-TV recently posted an informative Newsmakers episode in which Lisa Olliges-Green, KGCS-TV Station Manager, and Steve McIntosh, Jasper County Collector, provide an abundance of information regarding the program. The episode also includes helpful information about other laws and programs Missouri has to promote financial ease for seniors, and it can be watched on Youtube here: https://youtu.be/JIvk5AU2PdQ. For questions regarding the Senior Tax Credit in Jasper County, you can contact Steve McIntosh at 417-358-0409 or stop by the Jasper County Courthouse at 302 South Main St. Carthage, MO 64836.

To apply for the program, seniors must provide proof of residency, ownership, age, and a current tax receipt with the application in person at the Jasper County Courthouse Collector’s Office by May 31, 2025. To maintain eligibility, seniors must reapply every year. Forms can be obtained at the Collector’s Office or printed through the following link: https://jaspercountycollector.com/docs/jasper_app_sb190.pdf?PHPSESSID=hm8junaq18lmceqql v8tjc8705. Applications will be reviewed by the County Commission following submission, and a decision regarding approval or denial will be communicated through a Commission Order.

In summary, the new property tax credit in Jasper County and across Missouri gives seniors the opportunity to receive financial relief, helping to offset the rising costs of property taxes. While the application process may vary by county and involve community intervention to help seniors with applying, the benefits of the credit, along with other new laws which assist seniors with combatting this widespread issue, mark a significant step in ensuring the financial well-being of seniors in Missouri.